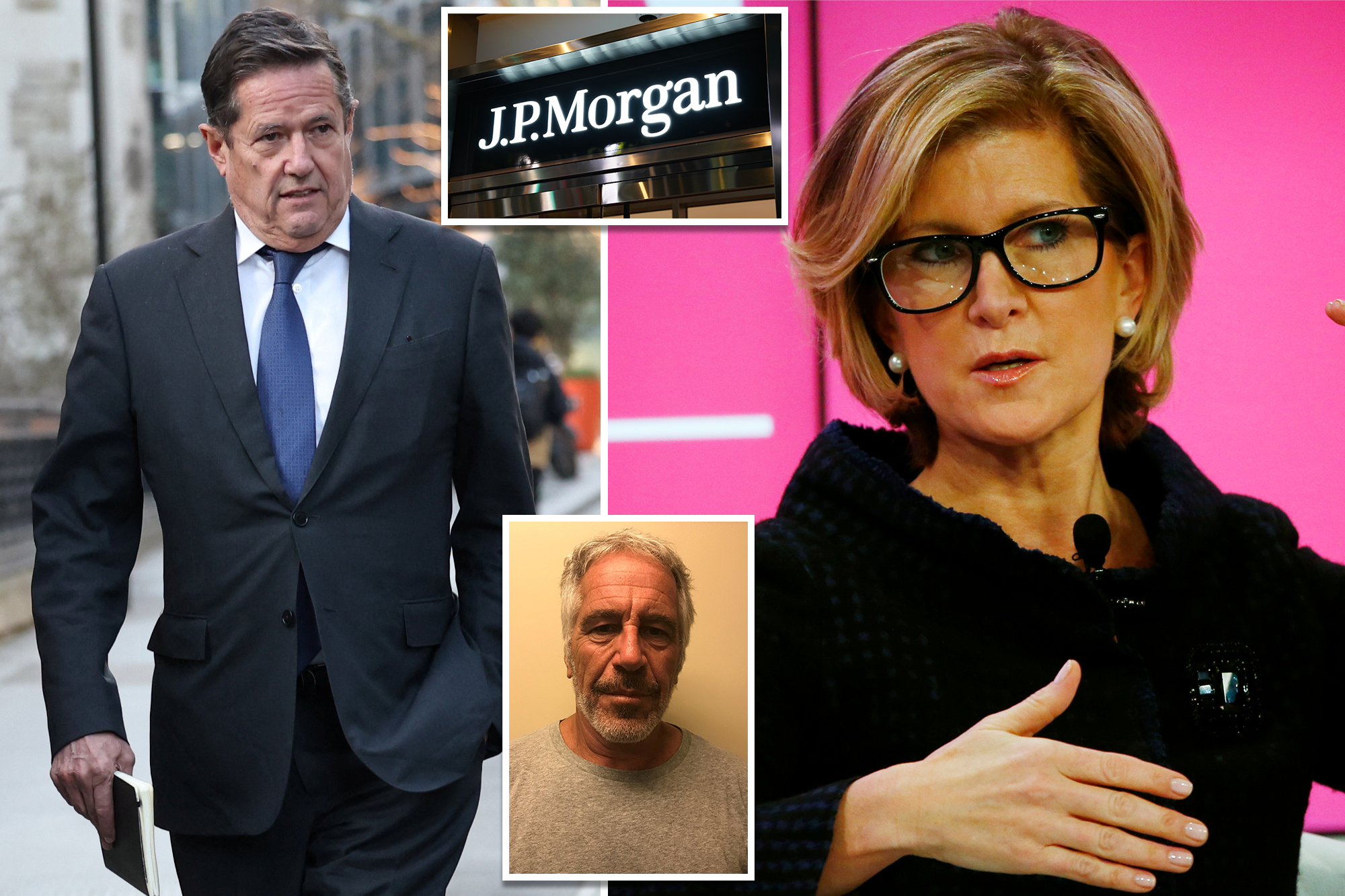

JPMorgan Chase reportedly processed more than $1 billion for Jeffrey Epstein over 15 years, a new investigation says — even as the registered sex offender pulled tens of thousands in cash each month and internal watchdogs flagged the activity as suspicious.

Senior JPMorgan leaders overrode compliance objections at least four times across five years and the bank even set up accounts for young women at Epstein’s request, according to a report by the New York Times.

The bank, in past statements, has said all accounts were properly documented and denies facilitating crimes.

Epstein was a prized JPMorgan client with over $200 million in his accounts, generating millions in revenue.

He brokered a key acquisition, steered in high-value clients like Google co-founder Sergey Brin, connected executives to world leaders including Benjamin Netanyahu and advised the bank on crises and strategy, according to the Times.

But a growing number of employees at JPMorgan feared that the bank’s continued association with a convicted pedophile who was still under federal investigation would harm the firm’s reputation, according to the Times, which sifted through thousands of pages of bank records and court documents.

Compliance alarms sounded as early as 2006, when a JPMorgan “Rapid Response” review documented routine $40,000 to $80,000 cash withdrawals several times a month, totaling more than $750,000 year-to-date — and nearly $1.75 million in cash before Epstein’s 2008 plea, court filings say.

The repeated withdrawals raised suspicions of money laundering among top bankers, the paper reported. It was later learned that Epstein set up accounts at JPMorgan which were used to transfer money to victims of his sex-trafficking operations, according to the report.

Stephen Cutler, then the bank’s general counsel, privately warned in 2011 that Epstein “should not be a client,” according to deposition excerpts made public last year.

He mulled banning Epstein, admitting he couldn’t justify to colleagues why the bank kept a convicted sex offender, but stopped short of escalating the issue to CEO Jamie Dimon, the Times reported.

Cutler did not see evidence that Epstein was using his accounts for criminal activity, according to the Times. Without firm action, JPMorgan let Epstein remain a client.

According to the Times, Epstein’s top backer inside the bank, wealth boss Jes Staley, pushed to keep him despite misgivings from other staffers.

The pair stayed in close contact — with Staley even offering support after Epstein’s 2006 arrest on charges of soliciting prostitution from a teenage girl.

In a 2023 deposition, Staley said he informed Dimon about the indictment and later met with him to discuss it, though Dimon has denied this under oath.

Erdoes circulated news of the case internally, calling it “so painful to read.” Staley replied that he had just seen Epstein, describing him as “shaken” and insisting Epstein denied involvement with underage girls.

Despite the severity of Epstein’s crimes, Staley and Erdoes privately joked about his arrest, according to the Times.

Staley emailed from a Hamptons fundraiser that “the ages between husband and wives would have fit in well with Jeffrey.” Erdoes reportedly replied that acquaintances were making “lots of comparisons to JE” and were “laughing about Jeffrey.”

JPMorgan convened a team to weigh whether to drop Epstein after his 2006 indictment but treated him far differently than another client, actor Wesley Snipes, who was swiftly expelled when charged with tax fraud, according to the Times.

Court records show Snipes was removed even before his case concluded, though he was later convicted only of tax misdemeanors. By contrast, despite Epstein’s sex-crime charge and an open Justice Department probe, JPMorgan kept him as a client.

An internal memo cited by the Times said the bank would not “proactively solicit new investment business” from Epstein following the 2006 indictment, yet Erdoes soon approved another loan, which a colleague welcomed as “relieved to hear,” according to the Times.

Even after Epstein pleaded guilty in 2008 and became a registered sex offender, internal emails show bankers saying “no one wants him,” but senior leadership still resisted cutting him loose, the Times reported.

JPMorgan ultimately opened scores of accounts for Epstein, his companies and associates; USVI filings say the bank moved millions tied to Ghislaine Maxwell and to women now identified as victims.

Internal emails show leaders joked about his interest in younger women while compliance teams noted he was “known to pay cash for his massages,” filings say.

The bank finally cut Epstein in 2013 — but its personnel continued meeting him for years, according to Times reporting based on internal calendars and sources.

JPMorgan now calls the Epstein relationship a mistake.

“We would never have continued to do business with him if we believed he was using our bank in any way to help commit heinous crimes,” a spokeswoman said last year as the bank settled civil suits.

Inside JPMorgan, blame-shifting has been intense. Dimon testified that Erdoes and Cutler could have removed Epstein at any time while Cutler and Erdoes pointed to Staley’s advocacy, according to the Times.

Erdoes, in a deposition, acknowledged being alerted to Epstein’s offender status and to suspicious activity years before the bank severed ties.

The legal fallout was costly. In June 2023, JPMorgan agreed to pay $290 million to Epstein’s accusers in a class action.

Three months later, it paid $75 million to the US Virgin Islands, which alleged the bank enabled sex-trafficking by providing cash and credibility as Epstein abused women and girls on Little St. James. The bank admitted no wrongdoing.

Deutsche Bank — which took Epstein’s business after JPMorgan’s 2013 break — separately paid $75 million to settle claims it ignored red flags. New York regulators had already fined Deutsche $150 million in 2020 for compliance failures tied to Epstein.

Staley, who left JPMorgan in 2013 and later ran Barclays, has denied knowing of criminal conduct. He is battling British regulators over a ban and fine over his past ties to Epstein.

In March, he defended his actions in London while regulators and court records highlighted his years of contact with Epstein, including messages of support during the 2008 jail stint.