Elliott Investment Management has taken a $4 billion stake in PepsiCo as the activist hedge fund led by billionaire Paul Singer presses for changes to boost the company’s stock price.

The Wall Street Journal first broke the news on Tuesday of Elliott’s position, now one of the soda maker’s biggest-ever investors, that helped lift shares in PepsiCo as high as 6%.

The stock was recently up 1.9% at $151.43.

In a letter to the beverage and snack giant’s board, Elliott outlined plans to boost the share price by 50%, which included forcing the company to refranchise its bottling operations to local and independent operators and potentially ax under-performing brands.

“While unfortunate, this disappointing trajectory has created a historic opportunity: With the right mindset and an appropriately ambitious turnaround plan, PepsiCo today represents a rare chance to revitalize a leading global enterprise and unlock significant shareholder value,” Elliott wrote in its letter.

“Elliott’s goals at PepsiCo are straightforward: help the Company sharpen focus, drive innovation, become more efficient and unlock the value that its leading brands, unmatched scale and worldclass employees deserve,” the letter added.

Pepsi soda, once the main rival to Coca-Cola, has fallen to fourth place in terms of US sales volume behind Coke, Dr Pepper, and Sprite, according to data from Beverage Digest.

Its food business, which accounts for 60% of revenues, is also under pressure.

Brands owned by the company include Doritos, Cheetos and Quaker Oats.

According to a June note to clients written by Wells Fargo analyst Chris Carey, sales growth in PepsiCo’s key North America food business has slowed each quarter since peaking in late 2022 and called for costs to be slashed.

Carey singled out PepsiCo’s Frito-Lay and Quaker Foods as suffering from weaker volumes and rising costs that are weighing heavily on operating margins.

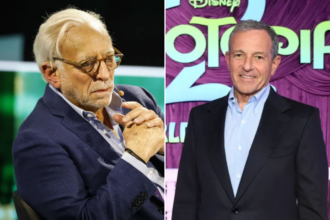

Activist investor Nelson Peltz’s Trian Fund Management failed in a bid to force PepsiCo about a decade ago to merge with food maker Mondelez and spin off its beverages unit.

PepsiCo has already been trying to cut costs, recently shuttering two manufacturing plants for its North American food business.

Executives are also trying to rein in spending on transportation and logistics, as well as analyzing its marketing budgets.

The company’s market value has dropped to about $200 billion currently, a roughly 25% decline from a peak of $270 billion in May 2023.

Rival Coca-Cola completed a similar large-scale effort in 2017. Coca-Cola’s market value is now nearly $300 billion, with shares near record highs.

The move by Elliott, which manages $76 billion of assets, is the firm’s latest high profile activist campaign after it shook up budget airline SouthWest and coffee giant Starbucks last year, replacing key executives at both corporations.